Depending on your objectives, there are numerous ways to structure your firm. If you want to set up a dual company structure, you need to understand the similarity and differences between a holding company and an operating company. This post will talk about the difference between the two and how this structure can lower risk and protect vital assets.

Operating companies vs. holding companies

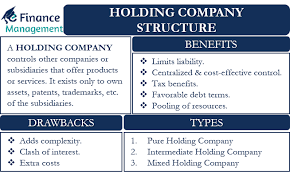

A holding company is a business that owns all of the stock of a subsidiary business. This structure allows the company to control its most important assets, such as cash and equipment, while keeping them separate from the subsidiary.

The operating company is a firm or a subsidiary that conducts all of the trade. Contracts, personnel hires, and customer interactions will all be handled by the operating company. Your operational firm is usually responsible for all business obligations because it is the public face of the dual structure. If something goes wrong within your company, the operating corporation could be held accountable.

We’ll further the difference between holding company vs operating company.

What a Holding Company Does

To own the stock of your operating company, you can establish a holding company. Your holding company won’t be in charge of running the business day-to-day or making goods or services. Instead, it will be used to own the stock in your operational firm and the major equipment employed in the company.

As your business grows, having a dual company structure may help protect it from risks better. In the same way, this organizational structure might make it easier for a company that is still growing and changing to run its business.

Typically, the same directors serve on the boards of both the holding company and the operating company. This gives the holding firm a centralized management structure that maximizes performance and growth.

What an Operating Company Does

Operating companies are those that conduct business under the control of their holding companies, which typically own all of the operating companies’ shares.

Holding companies that control operating companies must:

- Ensure that the operating company’s board of directors is composed appropriately;

- Have over 50% of votes cast at a general meeting of the operating company;

- Own more than 50% of the company’s issued shares.

Your operating company is in charge of negotiating the terms of any contract you make with a client. Also, they will take on all the risks and responsibilities that come with serving clients for the business.

In the business, all employees and contractors will be employed by the operating company. The operating company will be responsible for any issues that your business may have.

Final Words

Having a dual company structure can be a good option if you are establishing a business. Consider the business’s goals carefully before committing to this company structure. Operating and holding companies play different roles in your company, so it is important to consider:

- Do you have valuable assets in your business?

- Do you take on any material risks in your business?

Consult with a reliable tax professional who can assist you with any questions you may have about the dual company structure.